What Markets Hedge — and What They Ignore!

- r91275

- Jul 14, 2025

- 2 min read

What We Call Risk… Is Often Just Memory

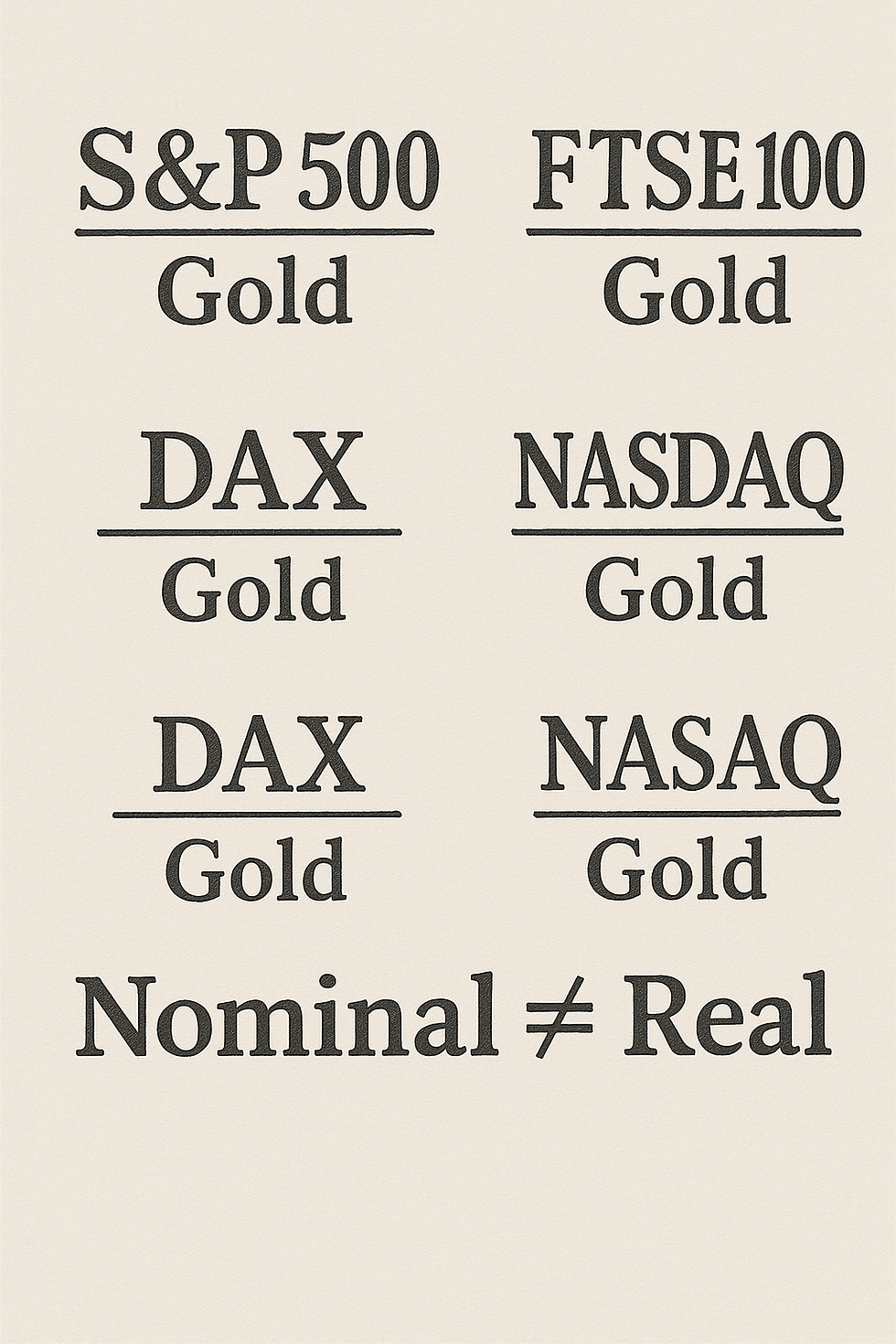

Markets are praised for their ability to price risk — to hedge, diversify, and manage exposure. But look closer, and a pattern emerges:

What markets hedge best is what they’ve already experienced. Inflation? Scarred into memory since the 1970s. Rate hikes? Feared since the taper tantrum. Volatility? Modelled to the decimal. These are the knowns. The manageable. The previously felt.

But what about the unfamiliar? What about the risks that don’t fit cleanly into a spreadsheet?

Risk Perception Is a Mirror of Collective Experience

Markets don’t hedge what’s most probable. They hedge what feels most proximate.

And what feels proximate is driven by recent experience, visible metrics, and institutional memory. So we get robust hedging for:

Currency risk

Credit events

Duration exposure

Equity volatility

But limited preparation for:

Governance breakdowns

Labour discontent

Demographic reversals

Geopolitical fragmentation

Cyber shocks

Are we managing reality — or managing what’s easy to model?

Some Risks Are Unseen Because They’re Inconvenient

Many structural risks don’t just lack data — they lack narrative fit. Climate risk is nonlinear. Social tension isn’t quarterly. Institutional erosion happens slowly, then suddenly. Markets sidestep these risks not because they’re unimportant — but because they resist quantification.

Do we underprice fragility because it doesn’t look like a trade?

When Hedging Creates Its Own Fragility

Sometimes, the very tools built to protect portfolios become accelerants.

Credit derivatives in 2008

“Short vol” products in 2018

Liability-driven investing (LDI) in 2022

All were designed to hedge. All became systemic stressors when crowded into the same corner. Because hedging isn’t neutral. It’s behavioural. When everyone moves together, the hedge becomes the risk.

Are we preparing for risk — or just clustering into the same reaction?

Implications for Investors: What's Actually Being Protected?

If a portfolio only hedges known volatilities, it’s still exposed — just in slower, subtler ways. True strategic resilience means asking:

What assumptions underpin my protection?

What systemic risks am I ignoring because they don’t move daily?

Where do I have exposure to stability that isn’t as stable as it looks?

Think beyond volatility. Think about systems. Think about sequence.

Are you protected from noise — but exposed to narrative collapse?

The Blind Spot Is Growing

As the world becomes more complex — geopolitically, socially, climatically — the temptation is to over-rely on what’s hedgeable. But that leaves a growing blind spot:

Social legitimacy

Resource fragility

Political unpredictability

These aren’t fat tails. They’re slow-building fractures. And when they move, it’s often too late to hedge.

What markets ignore isn’t always hidden. Sometimes it’s just inconvenient to remember.

Comments