Beyond the Tariffs: What’s Really Shifting

- r91275

- Apr 11, 2025

- 3 min read

Updated: Apr 13, 2025

The Quiet Reshaping of Everything

Everyone’s watching the tariffs. But that’s not the real story.

Behind the noise, something slower and more significant is taking place: a quiet restructuring of how the global economy works — and who it really works for.

At the centre of this shift: China and the United States. Two superpowers pulling the system in opposite directions. And the rest of the world, caught in the tension between them.

Undoing Interdependence

For decades, global growth was built on a simple logic: make things where it’s cheap, sell them where it’s rich.

China made. America bought. Capital flowed both ways. It wasn’t perfect — but it worked.

Now, that logic is being dismantled.

The U.S. no longer wants to depend on a strategic rival. China is reducing its exposure to U.S. financial dominance. The result is a deliberate — if chaotic — attempt to unwind a system that took 40 years to build.

Supply chains are shifting. Tariffs are back. Industrial policy is fashionable again. But for all the action, one reality remains:

The world wasn’t designed for a clean break.

Resilience at What Price?

Beneath the headlines lies a strategic goal: the U.S. wants to rebuild domestic manufacturing. Less dependency. More control. Resilience over efficiency.

Fair enough. But the way it’s happening — suddenly, publicly, and politically — is adding risk.

Nearly a third of global manufacturing still flows through China. Unwinding that overnight creates tension, not stability. And the more unpredictable the policy path, the harder it becomes for markets to adjust.

Is the U.S. actually reducing risk — or just moving it somewhere harder to track?

Cracks Beneath the Surface

While Washington focuses on where things are made, another shift is happening in parallel — this time in the financial system itself.

Since 2020, the U.S. has added over $11 trillion in debt. For decades, that wasn’t a problem. The world trusted the dollar. Treasuries were safety itself.

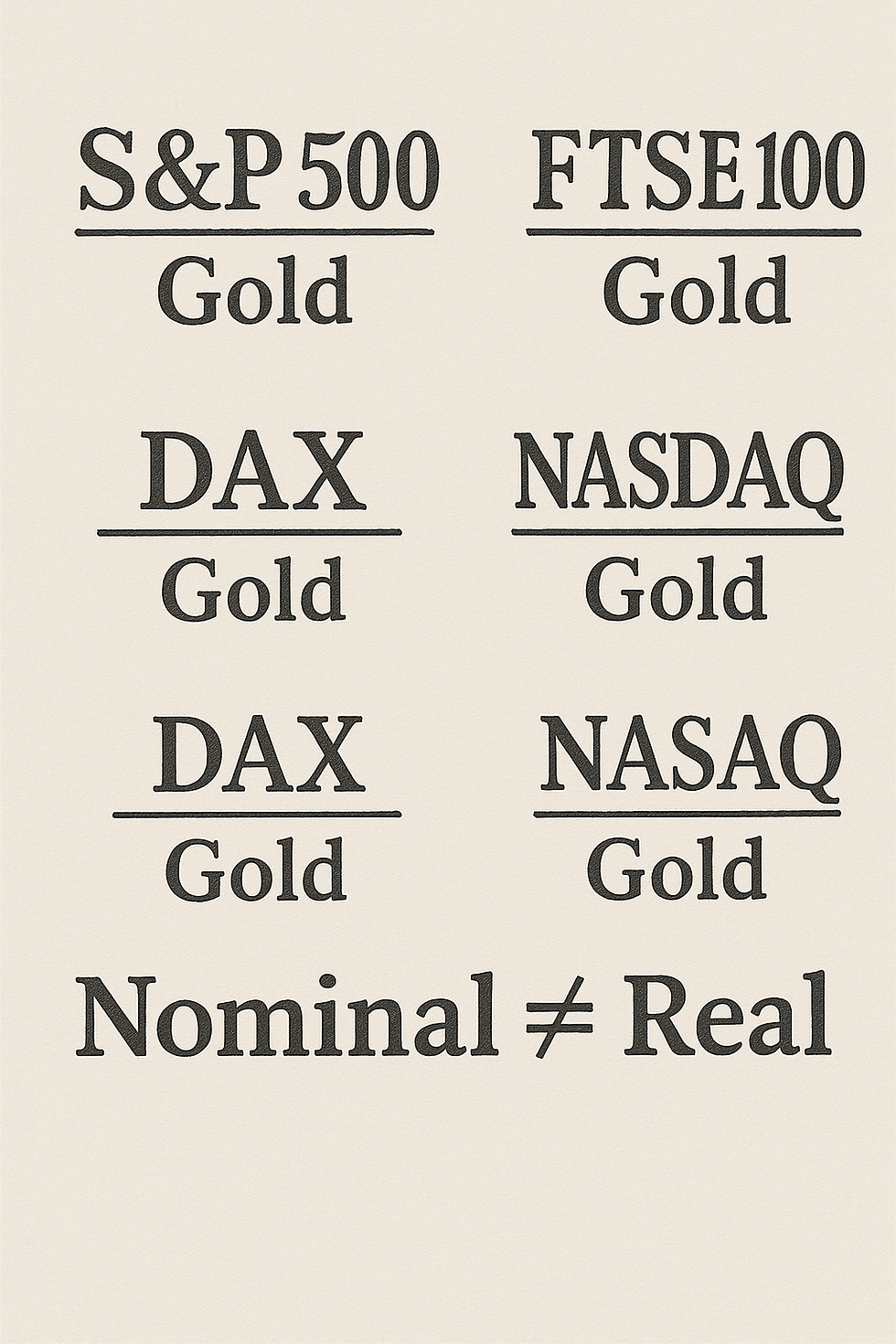

But trust doesn’t disappear all at once. It drifts. And the signals are drifting now:

– Yields are rising

– Gold is climbing

– The dollar is softening

These aren’t flukes. They’re symptoms.

If the U.S. remains the safest place to store capital, why is the capital starting to move?

China’s Paradox: Power Without Freedom

Yes, China is the rising power — economically, technologically, strategically. It dominates supply chains, leads in infrastructure, and holds significant global sway. But it’s not immune.

China holds over $750 billion in U.S. debt — giving it leverage, yes, but also constraint. If Beijing dumped Treasuries, the dollar would weaken — and the yuan would rise. That sounds like strength, but it would undercut China’s export engine.

And China still needs exports. It also needs:

– A stable dollar

– Global demand

– Foreign capital

– Time

Meanwhile, it’s managing:

– A fragile property sector

– Demographic decline

– Slowing growth

China wants to reduce its reliance on the U.S. — but it can’t afford to do it all at once. It’s a rising power still locked into the very system it’s trying to rewire.

A System Pulled From Both Ends

The global economy isn’t just competitive — it’s entangled.

– U.S. firms depend on Chinese manufacturing

– China depends on U.S. consumption

– Europe depends on American defence and dollar liquidity

Everyone’s exposed. No one’s in full control.

Is this system too big to fail — or simply too fragile to hold under pressure?

We’ve built an order where collapse is unthinkable — but coordination is no longer guaranteed. That’s not resilience. That’s a high wire act without a net.

The Rest of the World Hasn’t Chosen — Yet

This isn’t just a U.S.– China rivalry. It’s a system-wide squeeze.

– Europe trades with China, but relies on the U.S. for security

– Emerging markets borrow in dollars, but build with Chinese capital

– Corporates source from one side and list on the other

Nobody wants to pick sides. But the pressure is building.

The world wasn’t built for binary choices — but it may be forced into them.

When Strategy Turns into Confrontation

Tariffs are a tool. But what they reveal is bigger: this isn’t just a trade dispute.

It’s a structural transition. And it raises a deeper question:

Is there a limit to this economic contest — or are we watching the early stages of a geopolitical one?

Because when trade stops working as leverage, nations often reach for other tools. And when competition turns into confrontation, the rules don’t just shift — they collapse.

It’s not inevitable. But it’s no longer unthinkable. And the time to reflect on that is now — not later.

This Isn’t a Forecast — It’s a Frame

At Clarus Orbis, we don’t trade in predictions. We focus on systems — how they function, where they strain, and what questions need asking when the map no longer matches the terrain.

Thanks for reading.

Comments